Feb 14, 2024 | News to Note

From Barron’s – By Karen Hube As the 2023 tax-filing season kicks off, some taxpayers will find fewer hassles in dealing with the Internal Revenue Service compared with recent years, but most should keep a couple aspirin on hand—expect long waits and a stricter stance...

Jan 31, 2024 | News to Note

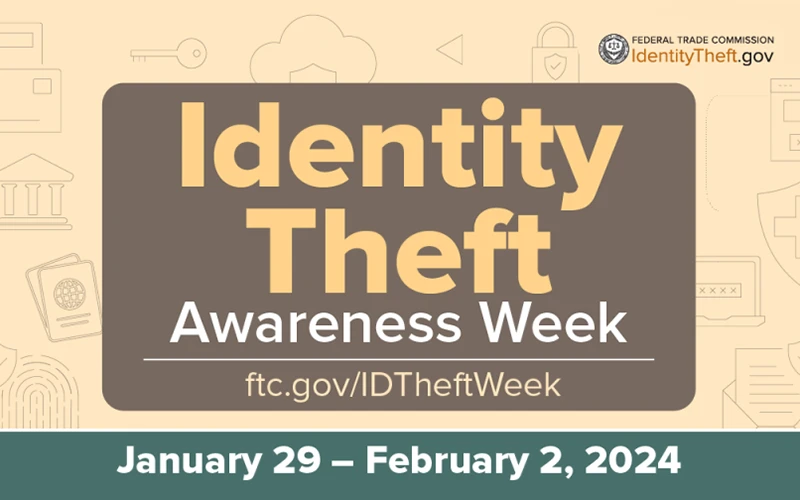

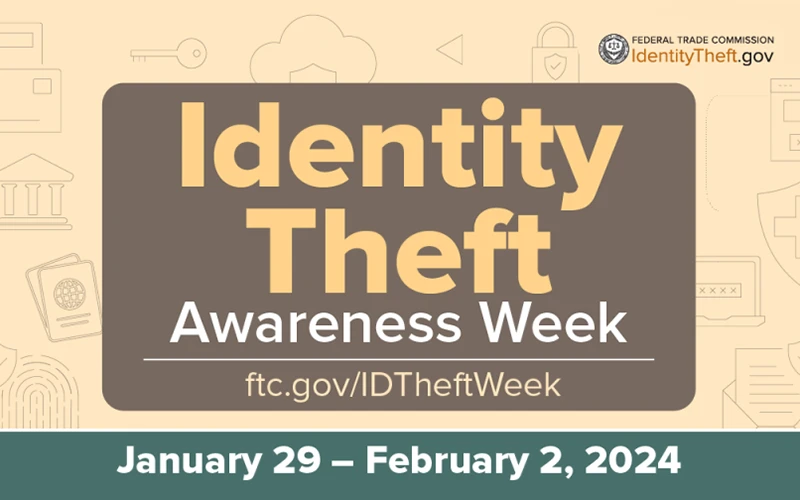

From the Federal Trade Commission — By Colleen Tressler — You’ve probably heard about identity theft, but have you heard about Identity Theft Awareness week? That’s when the FTC and its partners host free podcasts, webinars, Facebook Live interviews, and other...

Jan 24, 2024 | News to Note

From Barron’s — By Elizabeth O’Brien — Lawmakers are aiming to significantly reduce child poverty with a new bipartisan proposal that would expand child tax credits. The Tax Relief for American Families and Workers Act of 2024, unveiled Jan. 16, pairs relief...

Jan 17, 2024 | News to Note

From Forbes — By Jessica Ledingham, J.D., LL.M. — As tax season opens, millions of Americans are experiencing anxiety. The dreaded fear of owing money to Uncle Sam can be overwhelming, leading some to delay or completely disregard filing their taxes. You might...

Jan 10, 2024 | News to Note

From Barron’s — By Elizabeth O’Brien — Planning for your Medicare premiums isn’t on most preretirement checklists, but it’s an important consideration for those with higher incomes. Your Medicare premium for a given year is based on your income from two years...

Jan 3, 2024 | News to Note

Dear Clients, Starting Jan. 1, 2024, a significant number of businesses will be required to comply with the Corporate Transparency Act (“CTA”). The CTA was enacted into law as part of the National Defense Act for Fiscal Year 2021. The CTA requires the disclosure...