From Accounting Today —

By Michael Cohn —

Democrats on the tax-writing House and Ways Means Committee are asking the Justice Department and the Treasury Inspector General for Tax Administration to investigate former President Donald Trump’s attempt to enlist the Internal Revenue Service to audit former FBI director James Comey, deputy director Andrew McCabe and other political foes after they provoked his ire.

Rep. Bill Pascrell, D-New Jersey, who chairs the House Ways and Means Oversight Subcommittee, on Tuesday asked the DOJ to open a criminal probe after an article appeared Monday in The New York Times in which Trump’s former chief of staff, John Kelly, told him he wanted the IRS to investigate both Comey and McCabe. They both were fired by Trump and subjected to intense audits under a special IRS compliance program.

“Corrupting the integrity of our tax agency is a gravely serious offense,” Pascrell wrote in a letter Tuesday to Attorney Geneal Merrick Garland. “Nobody is above the law. The recent evidence that Mr. Trump specifically sought to use the tax laws for his own gain and direct the administration and enforcement of such laws to punish his enemies demands a thorough criminal investigation. The American people need to know that IRS is not subject to political influence and is focused on administering our tax system with competence and honesty. This cannot happen without a full investigation of criminal corruption at the IRS by Mr. Trump. Thank you for your attention to this urgent matter.”

The Treasury Inspector for Tax Administration opened a probe in July when reports surfaced of the rarely used audits against two top FBI officials, whom Trump blamed for investigations of Russian interference in the 2016 presidential election (see story). Former IRS commissioner Charles Rettig testified behind closed doors to Congress about the allegations (see story). IRS officials have insisted that the intensive tax audits are randomly selected under the IRS National Research Team.

On Monday, Pascrell teamed up with House Ways and Means Committee chairman Richard Neal, D-Massachusetts, to urge TIGTA to expand its probe in the wake of the corroboration by Kelly that Trump had requested the audits.

“When the first story broke, Commissioner Rettig said that he reached out to [TIGTA] regarding the matter,” they wrote. “This time, we are reaching out to TIGTA. We believe that TIGTA’s review of the IRS’s targeting of Mr. Comey and Mr. McCabe — the former President’s political enemies — should include the new information reported by the Chief of Staff in the New York Times. The actions of former President Trump continue to undermine public confidence in full and fair tax administration and this ‘enemies list’ is just the most recent example.”

Neal separately wrote a letter to IRS acting commissioner Douglas O’Donnell, who has temporarily succeeded Rettig after his term ended last week. The White House has announced its intention to nominate Daniel Werfel, a former IRS acting commissioner during the Obama administration, as permanent commissioner.

Neal asked for the IRS to conduct its own investigation of Trump’s possible weaponization of the IRS as well. “I request that the IRS provide a report on whether each of the people listed by former President Trump in the article for an ‘IRS investigation’ has been selected for an examination, audit, or other compliance initiative at any time from 2017-2022,” he wrote.

Kelly: Trump wanted audits of foes

Kelly told the Times that in addition to Comey and McCabe, Trump discussed using the IRS and the Justice Department to investigate former CIA director John O. Brennan; Hillary Rodham Clinton; Jeff Bezos, founder of Amazon and owner of the Washington Post; Peter Strzok, the lead FBI agent on the Russia investigation; and Lisa Page, an FBI official who exchanged text messages with Strzok critical of Trump.

The allegations add extra fuel to the outrage over the use of tax audits against Comey and McCabe, who have both testified about the pressure they came under from Trump during his administration. Pascrell wants the Justice Department to examine what happened with the tax audits under the National Research Program

“Given the comprehensive, cumbersome and costly nature of NRP audits, only a small number of taxpayers are selected for review each year to assist the IRS in compiling representative data about voluntary compliance,” Pascrell pointed out. “The NRP selected roughly 5,000 returns out of 153 million filed in 2017 and roughly 8,000 returns out of 154 million filed in 2019, making the odds of these two tax returns both being selected for review miniscule. As leaders of the Federal Bureau of Investigation, Mr. Comey and Mr. McCabe were frequent targets of politically motivated vitriol by Mr. Trump, and were falsely accused by Mr. Trump of treason, perjury, and fraud. The astronomically unlikely NRP audits of both men by the IRS under Charles Rettig, an appointee of Mr. Trump, reeks of corruption and criminality.”

Rep. Kevin Brady, R-Texas, the top Republican on the House Ways and Means Committee, defended the IRS’s actions.

“Former IRS Commissioner Rettig himself has disputed these claims, noting that he had no communication with President Trump and the research audits are statistically generated,” Brady said in a statement Monday. “I support allowing the Treasury Inspector General for Tax Administration to continue its investigation, consistent with the Ways and Means Committee precedent that led to confirming allegations of abuse by President Obama’s disgraced former IRS director Lois Lerner. The IRS should never be used as a weapon against political opponents as it was in the repeated targeting of conservative groups, the dangerous targeting of President Trump’s tax returns by this Democrat Congress, and the dangerous leaking of private tax returns under the Obama and Biden administrations. Presidents shouldn’t do it, nor should the Supreme Court grant majority parties in Congress nearly unlimited power to target and make public the tax returns of political enemies — which Democrats are seeking under the flimsy guise of ‘audit procedures.'”

Senate Finance Committee chairman Ron Wyden, D-Oregon, supports the probe. “No one is surprised Donald Trump tried to sic the IRS on his political enemies,” he said in a statement Monday. “He has no respect for the rule of law, and operates like a mob boss. For Republicans concerned about the potential for IRS political targeting—the calls were coming from inside the house. The Inspector General is investigating this disturbing matter, and I plan to reach out to General Kelly given the latest reporting from the New York Times.”

The news comes as Trump prepared to announce his 2024 presidential campaign Tuesday night, despite the losses endured by many of the most prominent Republican candidates he endorsed in the 2022 midterm elections this month, and in the midst of ongoing legal cases involving activities at his company and in his administration.

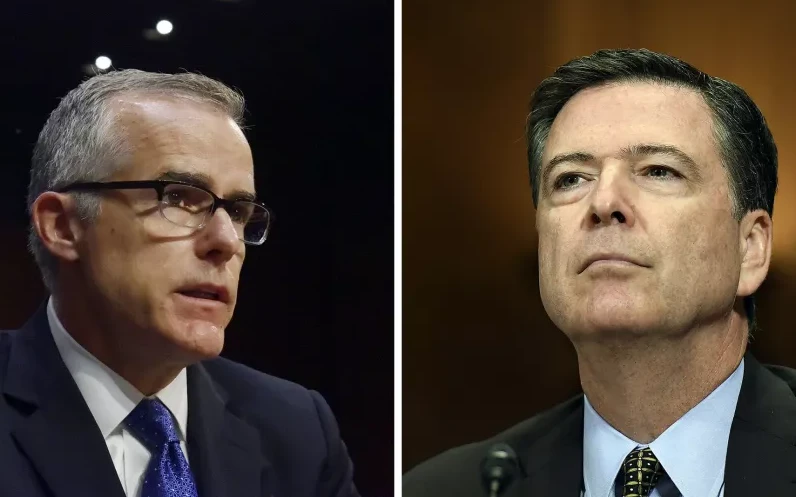

CAPTION: Andrew McCabe, left, and James Comey

Photos by Jahi Chikwendiu and Matt McClain/The Washington Post/Getty Images

Contact KM&M CPAs for help

If you are facing an IRS audit and need representation from a tax expert, contact Kleshinski, Morrison & Morris, CPAs. Call our office at 419-756-3211, reach us by sending email to kmm@kmmcpas.com, or just fill out the contact form on our website at this link.