From USA.gov —

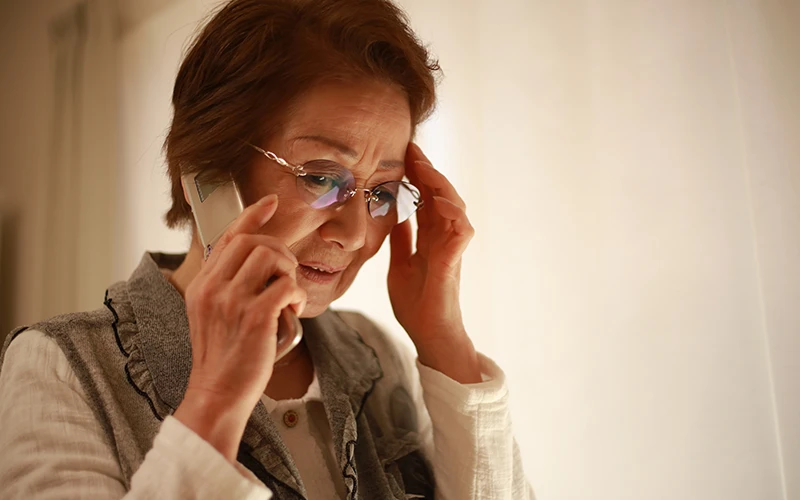

Imposter scammers pretend to be from the IRS or Social Security, a business, or a charity. They want you to trust them so they can steal your personal information and money.

Types of imposter scams

An imposter scammer may call, text, or email to convince you they are someone in authority. They try to get you to send money or a gift card or share personal information so they can commit ID theft.

Learn about the top types of imposter scams:

- IRS imposter scams — scammers pretend you owe the IRS money for taxes and may threaten legal action

- Social Security imposter scams — scammers claim there is a problem with your Social Security account or promise to increase your benefits

- Charity scams — scammers pretend to be from a real or fake charity and try to get you to contribute

- Grandparent scams — scammers pretend to be a grandchild or other relative who needs emergency financial help

- Scammers may also pretend to be from your bank or a company you do business with. You might be told you owe money or there is a problem with your account.

See examples of imposter scams, learn how they work, and how to recognize them from the Federal Trade Commission.

How to report imposter scams

Report imposter scams online to the FTC or call 1-877-382-4357 (TTY: 1-866-653-4261).

Contact Kleshinski, Morris & Morrison CPAs

If you need help to maximize available tax savings from your health insurance spending, or any type of professional accounting advice, please contact our experts at Kleshinski, Morrison & Morris CPAs. Call our office at 419-756-3211, reach us by sending email to kmm@kmmcpas.com, or just fill out the contact form on our website at this link.