A Report from the Institue on Taxations and Economic Policy – July 30, 2024 –

Key findings:

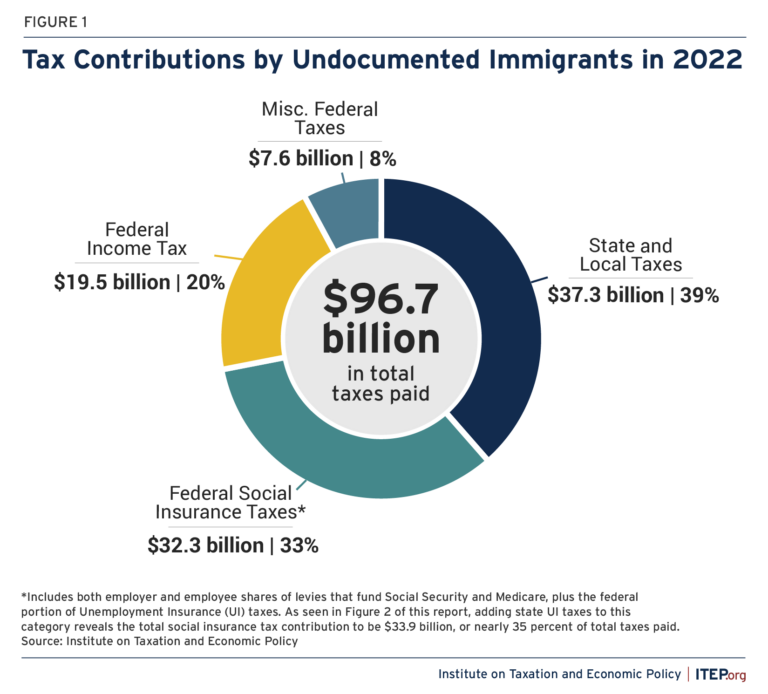

- Undocumented immigrants paid $96.7 billion in federal, state, and local taxes in 2022. Most of that amount, $59.4 billion, was paid to the federal government while the remaining $37.3 billion was paid to state and local governments.

- Undocumented immigrants paid federal, state, and local taxes of $8,889 per person in 2022. In other words, for every 1 million undocumented immigrants who reside in the country, public services receive $8.9 billion in additional tax revenue.

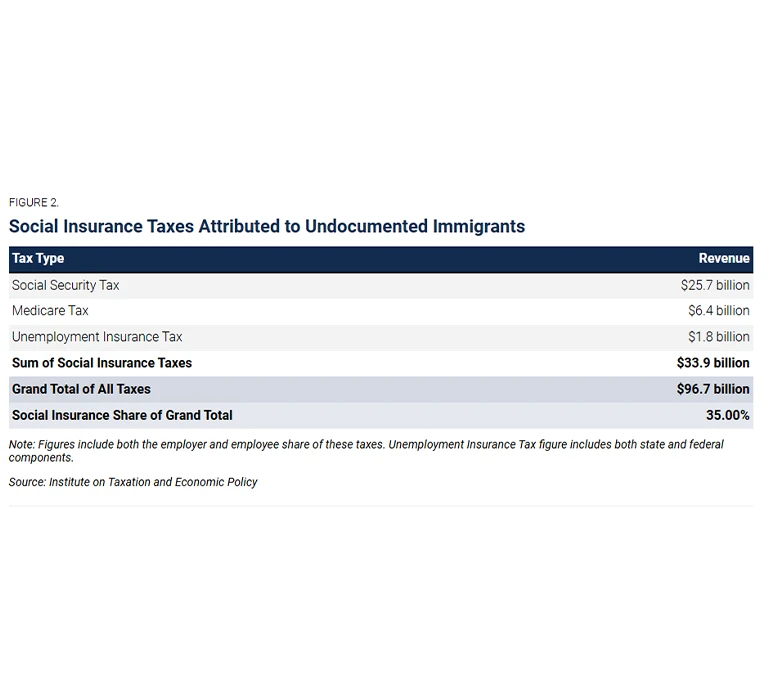

- More than a third of the tax dollars paid by undocumented immigrants go toward payroll taxes dedicated to funding programs that these workers are barred from accessing. Undocumented immigrants paid $25.7 billion in Social Security taxes, $6.4 billion in Medicare taxes, and $1.8 billion in unemployment insurance taxes in 2022.

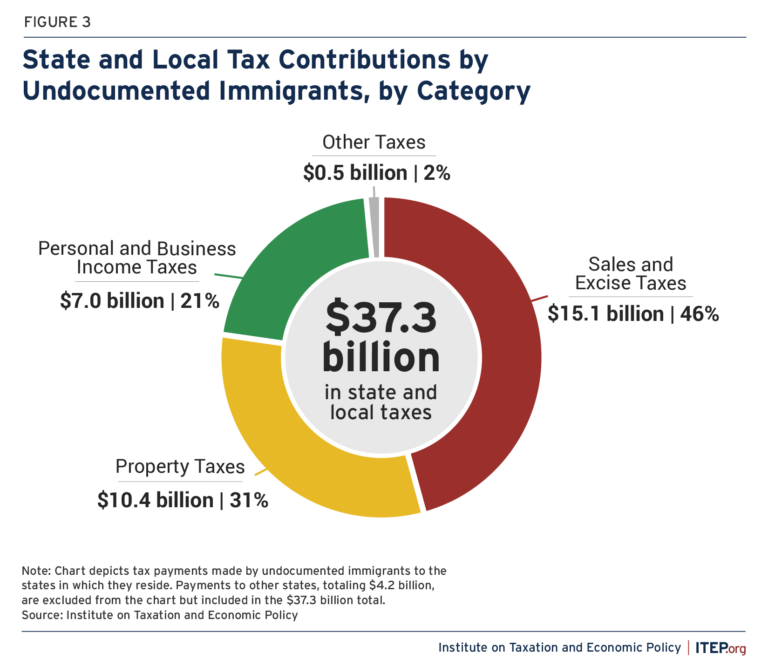

- At the state and local levels, slightly less than half (46 percent, or $15.1 billion) of the tax payments made by undocumented immigrants are through sales and excise taxes levied on their purchases. Most other payments are made through property taxes, such as those levied on homeowners and renters (31 percent, or $10.4 billion), or through personal and business income taxes (21 percent, or $7.0 billion).

- Six states raised more than $1 billion each in tax revenue from undocumented immigrants living within their borders. Those states are California ($8.5 billion), Texas ($4.9 billion), New York ($3.1 billion), Florida ($1.8 billion), Illinois ($1.5 billion), and New Jersey ($1.3 billion).

- In a large majority of states (40), undocumented immigrants pay higher state and local tax rates than the top 1 percent of households living within their borders.

- Income tax payments by undocumented immigrants are affected by laws that require them to pay more than otherwise similarly situated U.S. citizens. Undocumented immigrants are often barred from receiving meaningful tax credits and sometimes do not claim refunds they are owed due to lack of awareness, concern about their immigration status, or insufficient access to tax preparation assistance.

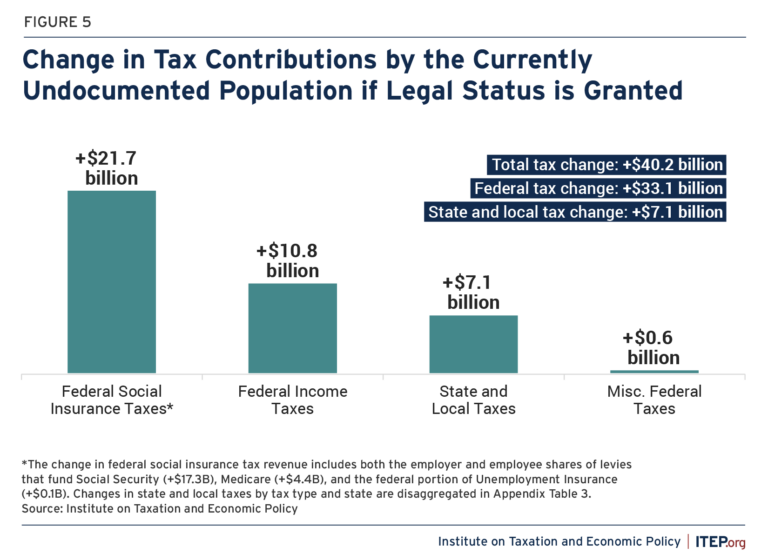

- Providing access to work authorization for undocumented immigrants would increase their tax contributions both because their wages would rise and because their rates of tax compliance would increase. Under a scenario where work authorization is provided to all current undocumented immigrants, their tax contributions would rise by $40.2 billion per year to $136.9 billion. Most of the new revenue raised in this scenario ($33.1 billion) would flow to the federal government while the remainder ($7.1 billion) would flow to states and localities.

Introduction

Immigration has always been an important part of the story of the United States. Today is certainly no exception.

Debates over immigration policy raise a huge array of issues that are fundamental to life in the U.S. To shed light on just one of those issues, this study undertakes the most thorough examination to date of the federal, state, and local tax payments made by undocumented immigrants.

To accomplish this, the study combines well-established techniques for estimating the size and tax-relevant characteristics of the undocumented population with the trove of data underlying ITEP’s comprehensive studies of U.S. tax incidence.[1] In doing so, it arrives at nationwide estimates of the overall tax contributions of the estimated 10.9 million undocumented immigrants living in the U.S. as of 2022, as well as state-by-state estimates for those immigrants’ payments of state and local taxes.[2] The report also forecasts the growth in tax contributions that would occur under a scenario in which these taxpayers were granted work authorization.

Current tax payments by undocumented immigrants

Current tax payments by undocumented immigrants

Federal, state, and local governments in the U.S. levy a wide array of taxes and most of those taxes affect undocumented immigrants in some fashion. Much like their neighbors, undocumented immigrants pay sales and excise taxes on goods and services like utilities, household products, and gasoline. They pay property taxes either directly on their homes or indirectly when these taxes are folded into the price of their monthly rent. And they pay income and payroll taxes through automatic withholding from their paychecks or by filing income tax returns using Individual Taxpayer Identification Numbers (ITINs).[3]

Using the method described in detail at the end of this report, we estimate that undocumented immigrants paid $96.7 billion in U.S. taxes in 2022, including $59.4 billion in payments to the federal government and $37.3 billion in payments to states and localities. Those tax payments are disaggregated by major category in Figure 1.

Given that the undocumented population included 10.9 million people in 2022, this $96.7 billion tax payment is equivalent to $8,889 per person. In other words, this analysis finds that for every 1 million undocumented immigrants who reside in the country, public services receive $8.9 billion in additional tax revenue. It bears noting that this figure includes only the taxes borne by undocumented immigrants and that other research attempting to quantify the significance of immigrants to the economy more broadly points toward a higher revenue impact per person.[4]

In total, the tax contribution of undocumented immigrants amounted to 26.1 percent of their incomes in 2022. This figure is close to the 26.4 percent rate facing the median income group of the overall U.S. population.[5] This closeness is the net result of factors that tend to lower the tax contributions of undocumented immigrants relative to U.S. citizens (such as lower incomes, lower income tax compliance, and lower smoking rates), as well as factors that tend to increase the contributions of those immigrants (such as tax credit restrictions, reduced likelihood of claiming refunds owed, and lower prevalence of tax-preferred retirement and investment income). These issues are discussed in more detail in the report methodology.

Most of the tax dollars paid by undocumented immigrants are collected through levies applied to their incomes. This includes broad income taxes as well as narrower payroll taxes levied on workers’ earnings that are dedicated to specific programs. It is well established that undocumented workers contribute to the solvency of major social insurance programs through their tax contributions.[6] They pay taxes that fund Social Security, Medicare, and Unemployment Insurance, among other programs, despite their exclusion from most of those benefits.[7] Figure 2 details the tax contributions that undocumented immigrants make under major social insurance programs.

While the federal government collects the bulk of its revenue through various kinds of income taxes, states and localities levy a wider array of tax types. Nearly 39 percent of the total tax dollars paid by undocumented immigrants are to state and local governments, for a total of $37.3 billion in 2022. Figure 3 disaggregates those payments by broad tax category.

The bulk of state and local tax payments by undocumented immigrants occur through sales and excise taxes on their purchases. The total state and local tax contribution of these families, in 2022, included $15.1 billion in sales and excise taxes, $10.4 billion in property taxes, $7.0 billion in personal and business income taxes, and $0.5 billion in other taxes to the states in which they live. Undocumented immigrants also paid another $4.2 billion in taxes to states aside from the ones in which they reside, mostly by making taxable purchases when traveling across state lines or by purchasing items from businesses located in other states that have passed some of their tax expense along to their consumers.

The undocumented immigrant population, and its tax contributions, are relatively concentrated in just a few states. Six states raised more than $1 billion each in tax revenue from undocumented immigrants in 2022, and together those states made up nearly two-thirds (64 percent) of all state and local tax collections from undocumented immigrants in that year. Those states are California ($8.5 billion), Texas ($4.9 billion), New York ($3.1 billion), Florida ($1.8 billion), Illinois ($1.5 billion), and New Jersey ($1.3 billion).

Measured relative to their incomes, undocumented immigrants nationwide paid an average effective state and local tax rate of 8.9 percent toward funding public infrastructure, services, and institutions in their home states. To put this in perspective, the nation’s most affluent taxpayers (those in the top 1 percent of the income scale) paid an average nationwide effective tax rate of just 7.2 percent to their home states.[8] Appendix Table 4 provides effective tax rate data by state and reveals that 40 states collect higher tax rates, relative to income, from undocumented immigrants than from the top 1 percent of households living within their borders.

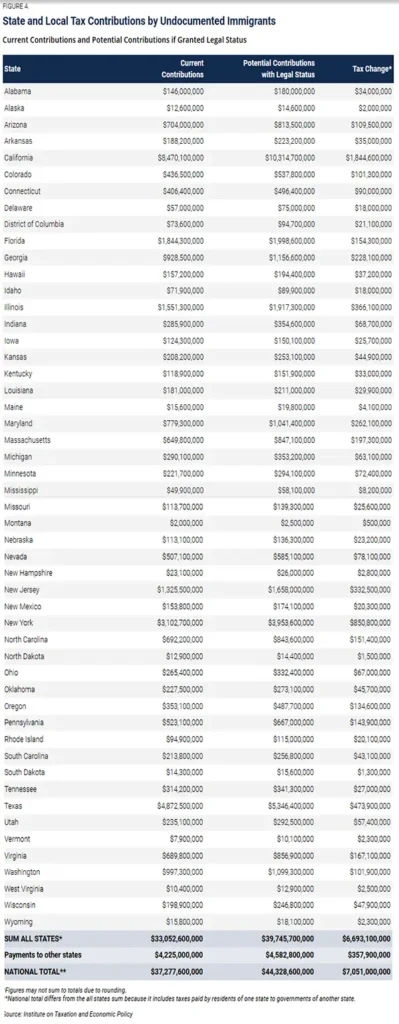

State-by-state data on the tax contributions of undocumented immigrants can be found in Figure 4 and in the appendix to this report.

In many respects, undocumented immigrants face a harsher tax code than legal residents. They often pay taxes that are dedicated to funding programs from which they are barred from participating because of their immigration status. In addition, undocumented immigrants and the citizen members of their families are ineligible for the federal Earned Income Tax Credit (EITC).[9] While some states have moved to make more taxpayers eligible for state EITCs regardless of immigration status, most states still exclude taxpayers filing with ITINs. On top of that, only qualifying taxpayers with children with Social Security Numbers (SSNs) qualify for the federal Child Tax Credit (CTC) and a few states with CTCs have chosen to mimic this restriction in their own CTCs. While some kids — with valid taxpayer identification numbers — may qualify for the Credit for Other Dependents, the credit value is only one-fourth the size of the federal CTC and is not refundable.[10]

Steps toward more immigrant-inclusive tax policies have been uneven in recent years. On the one hand, the 2017 Trump tax law added the SSN requirement for the Child Tax Credit that has barred many immigrant children and their families from benefiting. On the other hand, a growing number of states have chosen a more inclusive path with their own tax credits in recent years. Roughly one-third of states with EITCs and most states with CTCs have written their tax laws to be inclusive of children who do not qualify for an SSN.[11]

Effect of work authorization on undocumented immigrant tax contributions

Undocumented immigrants work without authorization and, as a result, their tax contributions are lower than what would be paid by a worker with legal status in an otherwise comparable position. Granting work authorization to undocumented immigrants would increase their tax contributions for two reasons.

First, income tax revenues would increase because legal status would lessen barriers to complying with existing income tax laws. Second, the data demonstrate that immigrants with employment authorization earn higher wages than undocumented immigrants.[12] Greater access to job opportunities and higher-level education would provide immigrants with the opportunity to earn substantially higher wages which would have the effect of raising taxable earnings, consumption, and property ownership.

We estimate that providing access to work authorization to the currently undocumented population would boost their overall tax contribution by $40.2 billion per year, from $96.7 billion to $136.9 billion. As seen in Figure 5, $33.1 billion of that increase would occur through higher federal tax payments while the other $7.1 billion would occur through higher tax payments to states and localities. Disaggregation of the state and local figure by state is available in Figure 4 and Appendix Table 3.

Recipients of Deferred Action for Childhood Arrivals (DACA) already have access to work authorization and are therefore not included in these estimates of expanded access to work authorization, or in the other estimates contained in this report.

Conclusion

Undocumented immigrants pay substantial amounts toward the funding of public infrastructure, institutions, and services. Specifically, we find that in 2022, undocumented immigrants paid $96.7 billion in taxes at the federal, state, and local levels. More than a third of that amount, $33.9 billion, went toward funding social insurance programs that these individuals are barred from accessing because of their immigration status.

In total, the federal tax contribution of undocumented immigrants amounted to $59.4 billion in 2022 while the state and local tax contribution stood at $37.3 billion. These figures make clear that immigration policy choices have substantial implications for public revenue at all levels of government.

ITEP researchers and analysts Carl Davis, Marco Guzman and Emma Sifre authored the Tax Payments by Undocumented Immigrants report released on July 30, 2024.

See Appendix B for the methodology used to calculate the estimates contained in this report.

Contact Kleshinski, Morris & Morrison CPAs

Need tax advice? Contact the experts at Kleshinski, Morrison & Morris CPAs. Reach us by phone at 419-756-3211, email to kmm@kmmcpas.com, or by filling out the contact form on this website here.