From USA Today – By Maya Marchel Hoff –

The conversation around eliminating taxes on tips for service and hospitality workers is being reignited after former President Donald Trump and Vice President Kamala Harris have come out in support of it on the campaign trail.

Both candidates proposed the idea months apart in rallies held in Las Vegas, which has one of the largest populations of tipped workers in the country.

Harris most recently called for lifting the tax on tips along with raising the federal minimum wage at her Las Vegas rally after Trump, who accused her of copying his idea, originally called to eliminate the tip tax back in June.

“It is my promise to everyone here: When I am President, we will continue our fight for working families of America, including to raise the minimum wage and eliminate taxes on tips for service and hospitality workers,” Harris said.

This rare policy agreement between the candidates comes as both are vying to win over voters in the key swing state. While Trump has released a vague policy plan, Harris has yet to share one.

For Harris to deliver on lifting the tip tax, legislation would have to make it through Congress, her campaign told Reuters, but economic experts are sounding alarms, saying this move would have negative impacts on the federal budget and the broader economy.

Whose tips are taxed?

Roughly 4 million workers, or less than 3% of the U.S work force, regularly earns tips through their jobs. This includes service industry workers such as wait staff, bartenders, hairstylists and baristas.

With the federal minimum wage at $2.13 an hour, tipped workers must earn at least $7.25 an hour total with tips, or the employer has to make up the rest, but wages vary across states and cities.

Service industry tips are taxed because they are considered part of income, but a third of tipped workers don’t make enough to pay any federal income taxes, according to the Budget Lab at Yale University.

There are a handful of ways tips are taxable, including if they are cash tips over $20 earned in a one-month period, electronic tips or tips received through pools, splitting or sharing arrangements with other employees, according to Intuit Turbo Tax.

Where did the idea come from?

While Trump blamed Harris for copying his idea to remove the income tax on tips, the concept came years before he entered politics. Republican Rep. Ron Paul in 2007 introduced legislation in the House to exempt tips from both federal income and payroll taxes, which didn’t end up going anywhere.

The idea has recently been revived in Congress after Republican Sen. Ted Cruz introduced a bill exempting tips from federal income tax. It has received bipartisan support from Nevada Democrats, Sens. Jacky Rosen and Catherine Cortez Masto.

How much is collected from tip taxes?

American workers paid about $38 billion in taxes on tips in 2018, which is a small slice of the federal pie compared to the $7 trillion collected by the Internal Revenue Service that same year, according to IRS figures.

This comes from the median earning for wait staff in the U.S., which is about $32,000 a year, or $15.36 an hour, according to the U.S. Bureau of Labor Statistics.

However, economic experts say eliminating taxes on tips could add to the federal deficit.

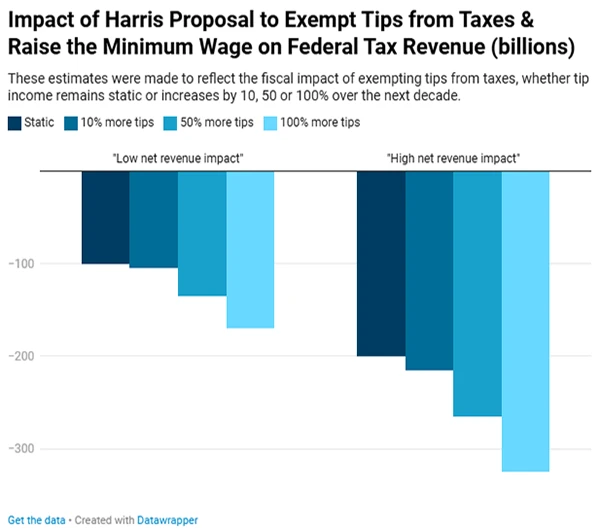

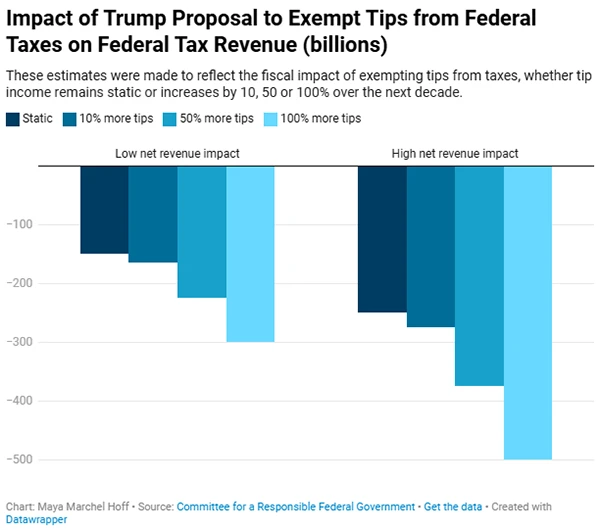

The Committee for a Responsible Federal Budget, a nonpartisan fiscal watchdog group, estimated it could reduce federal revenues by $150 to $250 billion over the next decade.

According to the Committee for a Responsible Federal Budget’s estimates, the increase to the federal deficit would vary between Trump’s and Harris’ plans based on the assumption that the Republican front runner’s policy would eliminate income and payroll taxes on tips.

Contact Kleshinski, Morris & Morrison CPAs

Need tax advice? Contact the experts at Kleshinski, Morrison & Morris CPAs. Reach us by phone at 419-756-3211, email to kmm@kmmcpas.com, or by filling out the contact form on this website here.