Dec 28, 2022 | News to Note

From NextAdvisor in Partnership with TIME — BY ALEX GAILEY, FEATURED CONTRIBUTOR — That time of year is right around the corner. I’m not talking about the holidays. I’m talking about tax season. While taxes might be the furthest thing from your mind right now, there...

Dec 21, 2022 | News to Note

From the Federal Trade Commission (FTC) — You may get a call, a text message, or a flyer in the mail. Or maybe you’ll see an online ad promising free or low-cost vacations. Scammers and dishonest companies are often behind these offers. You may end up...

Dec 14, 2022 | News to Note

From Axios — BY EMILY PECK — There’s a tax headache ahead next year for millions of Americans who use apps like Venmo or Paypal regularly, part of a little-noticed change passed in March as part of the American Rescue Plan. Why it matters: Anyone who was paid...

Dec 8, 2022 | News to Note

From Forbes — By E. Napoletano, Contributor — According to a recent study by Cerulli Associates, there’s a massive transfer of wealth poised to happen in the U.S. over the next 25 years. An estimated $68 trillion will change hands, with the country’s aging population...

Nov 30, 2022 | News to Note

From Accounting Today — By Michael Cohn — The Internal Revenue Service is being pushed by the Government Accountability Office to do more to close the $428 billion annual tax gap by using the extra $80 billion it’s getting over 10 years from Congress to improve...

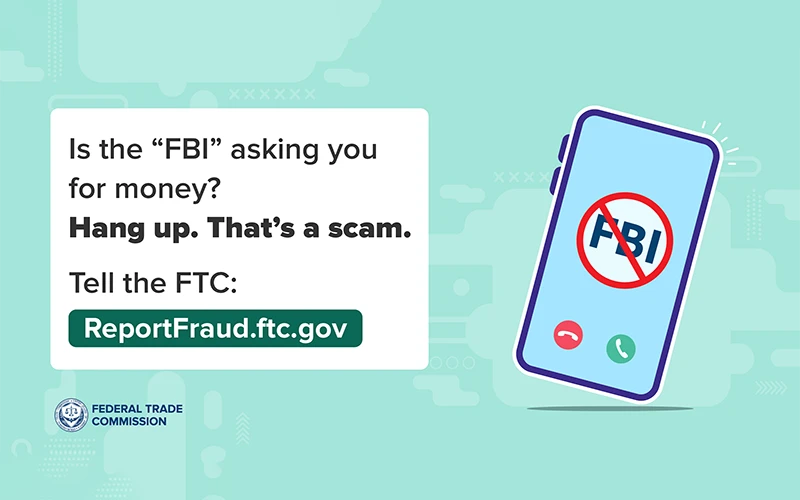

Nov 23, 2022 | News to Note

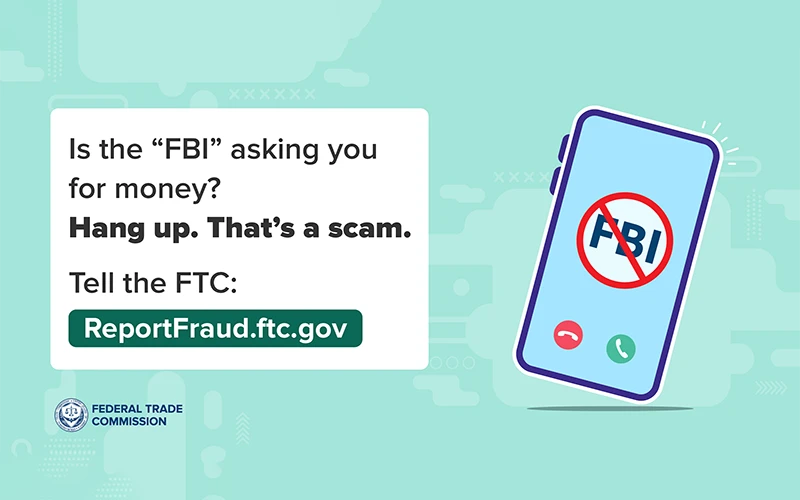

From the Federal Trade Commission (FTC) — By Gema de las Heras, Consumer Education Specialist — Unwanted calls are annoying — but when a caller says they’re an FBI agent collecting on a legal judgment entered against you, it’s also scary. No matter how urgent and...