Nov 16, 2022 | News to Note

From Accounting Today — By Michael Cohn — Democrats on the tax-writing House and Ways Means Committee are asking the Justice Department and the Treasury Inspector General for Tax Administration to investigate former President Donald Trump’s attempt to enlist...

Nov 9, 2022 | News to Note

From Thomson-Reuters and the Pinnacle CPA Advisory Group — To our Clients and Friends, The IRS sets up compliance campaigns to address areas where it believes there are significant issues. In other words, these are areas where the IRS thinks there is an opportunity to...

Nov 2, 2022 | News to Note

From AARP — If you’re 50 or older, there is one benefit to reaching this milestone that you may be overlooking: tax breaks aimed right at you. Now you can contribute more to your Roth or traditional individual retirement account (IRA), to your employer-sponsored plan...

Oct 26, 2022 | News to Note

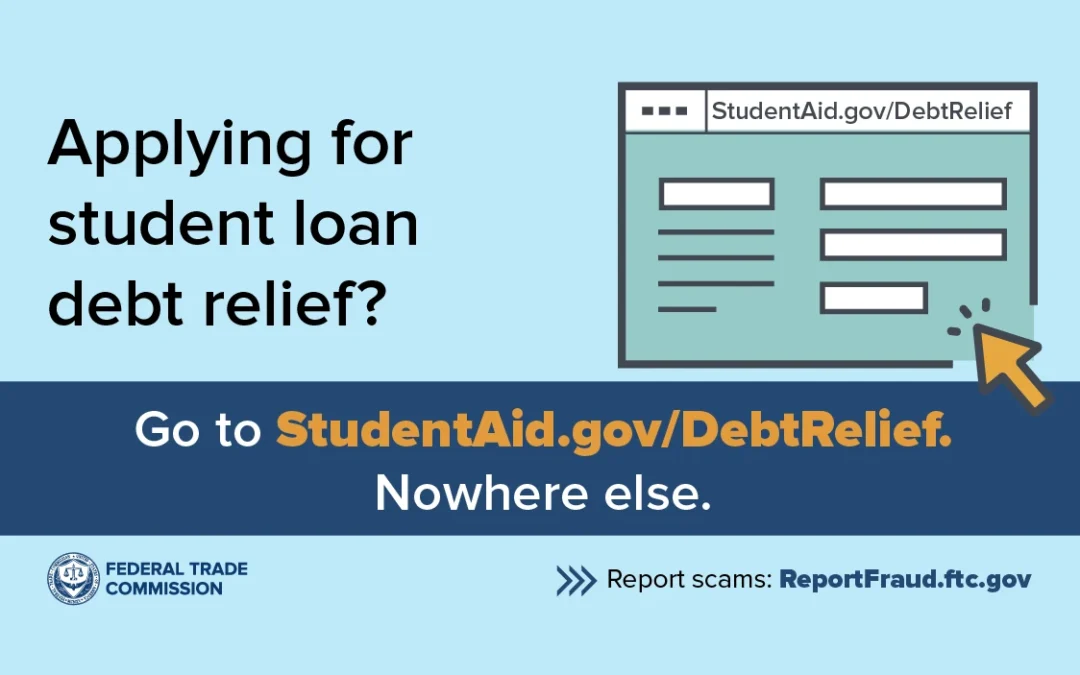

From CNN Business — By Jeanne Sahadi — The IRS this month announced a record increase in contribution limits to 401(k) and other tax-deferred retirement plans for 2023. Starting next year, you will be allowed to contribute up to $22,500 into your 401(k), 403(b), most...

Oct 19, 2022 | News to Note

From FTC.gov — By K. Michelle Grajales, Attorney, Division of Financial Practices — The Department of Education (ED)’s application for federal student loan debt relief is now open and, of course, scammers are on the move — trying to get your money and personal...

Oct 12, 2022 | News to Note

From MSN.com — By Christine Williams — In an effort to streamline the regulation that governs how retirement accounts can be used, the IRS has proposed a change for 403(b) plans — a type of workplace retirement plan use mostly by public and non-profit employees....