Sep 18, 2024 | News to Note

From Fortune – By Jane Thier – It’s good to be young. Even better if you have rich parents. But they’ve got to act quickly: If Democratic nominee Kamala Harris is elected in November—which many polls predict will happen—ultra-wealthy parents will have a much harder...

Sep 4, 2024 | News to Note

From Smart Asset – By Mark Henricks – Converting a 401(k) to a Roth IRA can potentially provide valuable long-term benefits, but it also triggers a tax bill that you’ll need to plan for. While the taxes on a Roth conversion can’t be avoided, savers can reduce the...

Aug 28, 2024 | News to Note

From CNBC – By Greg Iacurci – Travelers, be warned: The federal government may revoke your passport if you ignore a big tax bill. Such punishments have become more frequent in recent years, experts said. Federal law requires the IRS and Treasury Department to notify...

Aug 21, 2024 | News to Note

From Marketplace – By Kimberly Adams – Many provisions of the 2017 tax law are set to expire at the end of 2025. Advocates are already attempting to convince Congress to extend or make permanent key provisions, even as concerns about the growing budget deficit make...

Aug 14, 2024 | News to Note

From USA Today – By Maya Marchel Hoff – The conversation around eliminating taxes on tips for service and hospitality workers is being reignited after former President Donald Trump and Vice President Kamala Harris have come out in support of it on the campaign trail....

Jul 31, 2024 | News to Note

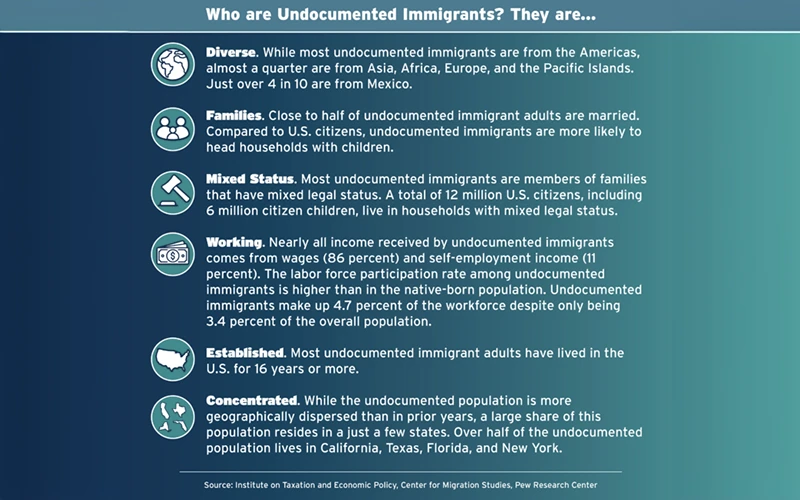

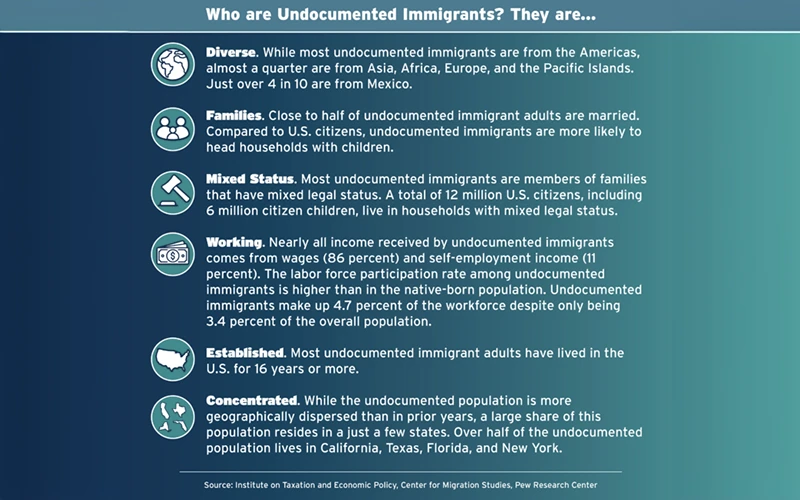

A Report from the Institue on Taxations and Economic Policy – July 30, 2024 – Key findings: Undocumented immigrants paid $96.7 billion in federal, state, and local taxes in 2022. Most of that amount, $59.4 billion, was paid to the federal government while the...