FEATURED ARTICLES & TAX TIP BLOG

Welcome to the KM&M CPAs Featured Articles & Tips Blog. Here we share tax and accounting news and tips for our clients on a regular basis. Please feel free to suggest ideas for topics you would like to see addressed, by dropping an email to [email protected]. Enjoy the articles and subscribe to our newsletter for periodic email updates.

8 tips for managing a financial windfall

From Forbes — By E. Napoletano, Contributor — According to a recent study by Cerulli Associates, there’s a massive transfer of wealth poised to happen in the U.S. over the next 25 years. An estimated $68 trillion will change hands, with the country’s aging population...

IRS prodded to spend more, to target the tax gap

From Accounting Today — By Michael Cohn — The Internal Revenue Service is being pushed by the Government Accountability Office to do more to close the $428 billion annual tax gap by using the extra $80 billion it's getting over 10 years from Congress to improve...

Is the FBI calling to ask you for money? Hang up. That’s a scam

From the Federal Trade Commission (FTC) — By Gema de las Heras, Consumer Education Specialist — Unwanted calls are annoying — but when a caller says they’re an FBI agent collecting on a legal judgment entered against you, it’s also scary. No matter how urgent and...

Probes sought of whether Trump used IRS against critics

From Accounting Today — By Michael Cohn — Democrats on the tax-writing House and Ways Means Committee are asking the Justice Department and the Treasury Inspector General for Tax Administration to investigate former President Donald Trump's attempt to enlist the...

IRS compliance looking at partnership distributions, ‘outside basis’

From Thomson-Reuters and the Pinnacle CPA Advisory Group — To our Clients and Friends, The IRS sets up compliance campaigns to address areas where it believes there are significant issues. In other words, these are areas where the IRS thinks there is an opportunity to...

Tax breaks after 50 you can’t afford to miss

From AARP — If you’re 50 or older, there is one benefit to reaching this milestone that you may be overlooking: tax breaks aimed right at you. Now you can contribute more to your Roth or traditional individual retirement account (IRA), to your employer-sponsored plan...

IRS increases allowed 401(k) contribution limits for 2023

From CNN Business — By Jeanne Sahadi — The IRS this month announced a record increase in contribution limits to 401(k) and other tax-deferred retirement plans for 2023. Starting next year, you will be allowed to contribute up to $22,500 into your 401(k), 403(b), most...

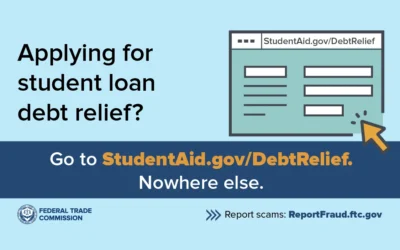

Now that the student loan debt relief application is open, spot the scams

From FTC.gov — By K. Michelle Grajales, Attorney, Division of Financial Practices — The Department of Education (ED)’s application for federal student loan debt relief is now open and, of course, scammers are on the move — trying to get your money and personal...

IRS changing how 403(b) plan beneficiaries receive funds

From MSN.com — By Christine Williams — In an effort to streamline the regulation that governs how retirement accounts can be used, the IRS has proposed a change for 403(b) plans — a type of workplace retirement plan use mostly by public and non-profit employees....