FEATURED ARTICLES & TAX TIP BLOG

Welcome to the KM&M CPAs Featured Articles & Tips Blog. Here we share tax and accounting news and tips for our clients on a regular basis. Please feel free to suggest ideas for topics you would like to see addressed, by dropping an email to [email protected]. Enjoy the articles and subscribe to our newsletter for periodic email updates.

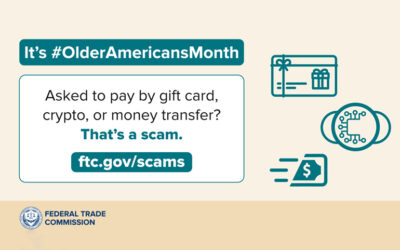

Avoid scammers’ money grabs during Older Americans Month

From the Federal Trade Commission’s FTC.gov — Scammers use lots of different tactics — stories about grandchildren in distress, million-dollar prizes, a romantic future, or a business deal — to try to steal peoples’ money. Scammers may demand payment by wire...

How your Medicare premiums can affect your taxes

From Thomson-Reuters and the Pinnacle CPA Advisory Group — Medicare health insurance premiums can add up to big bucks, especially if your income exceeds certain thresholds. Here's a summary of the different types of Medicare premiums and how they can affect your...

High inflation: How long will it last?

From Pinnacle Wealth Planning Services, Inc. — In March 2022, the Consumer Price Index for All Urban Consumers (CPI-U), the most common measure of inflation, rose at an annual rate of 8.5%, the highest level since December 1981.1 It's not surprising that a Gallup...

National Small Business Week: Plan to use ’22 tax benefits

From IRS.gov — Enhanced deduction for business meals, home office and more available this tax year WASHINGTON — The Internal Revenue Service on Monday, May 3, urged business taxpayers to begin planning now to take advantage of the enhanced 100% deduction for business...

Tax tips for entrepreneurs with startup small businesses

From NextAvenue.org — As she celebrates one year in business, Patricia Wynn gets expert advice on how to tackle taxes | By Leslie Hunter-Gadsden | For new small business owners like Patricia Wynn, April signifies not only spring but also filing taxes for their...

What to expect for tax refunds from the IRS this year

From the IRS — The IRS issues more than 9 out of 10 refunds in less than 21 days. However, it’s possible your tax return may require additional review and take longer. The IRS' Where’s My Refund? tool has the most up to date information available about your refund....

Financial literacy: Protect yourself from scammers

From the Federal Trade Commission — April kicks off Financial Literacy Month, which is often about managing your money and building savings. But this month, we want to talk about protecting what you have, and what you’re building, from scammers. Scammers are good at...

Cybersecurity advice: Protect your connected devices, accounts

Consumer Advice from the Federal Trade Commission — For so many of us, cell phones and computers are embedded in our personal and professional lives. We talk and text, we browse the web, we watch, and we create. Our devices store a lot of personal information, so...

Federal Income Tax Returns Due April 18 for Most

From Pinnacle Wealth Planning Services — Federal income tax returns are due for most individuals on Monday, April 18, 2022 (Tuesday, April 19, 2022, if you live in Maine or Massachusetts). Need more time? If you're not able to file your federal income tax return by...