Feb 19, 2025 | News to Note

From the Journal of Accountancy/AICPA & CIMA — By Martha Waggoner — A bill to extend the deadline for an estimated 32 million small businesses to report their beneficial ownership information (BOI) as mandated by the Corporate Transparency Act (CTA) passed the...

Feb 12, 2025 | News to Note

From CBS News — By Angelica Leicht — Tax season can be complicated, and for many people, the biggest concern on April 15 each year is not just how much they owe, but how long they have to pay. After all, millions of Americans find that they owe more on their...

Feb 5, 2025 | News to Note

From the IRS — WASHINGTON — The Internal Revenue Service in a news release issued Monday, Feb. 3, reminded taxpayers that choosing the right tax professional is essential to helping them avoid tax-related identity theft and financial harm. The release: While most...

Jan 29, 2025 | News to Note

From the IRS — WASHINGTON — The Internal Revenue Service opened the 2025 tax filing season on Monday, Jan. 27, and is accepting and processing federal individual tax year 2024 returns. During Monday’s early morning opening, IRS systems have already received millions...

Jan 15, 2025 | News to Note

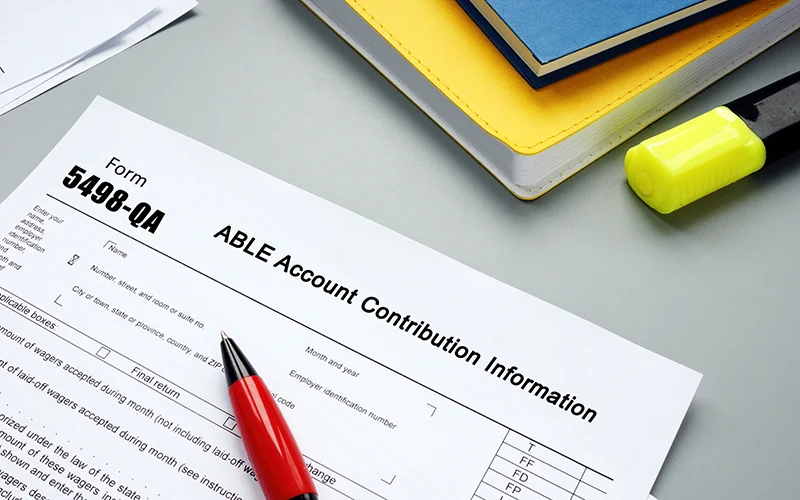

From Disability Scoop — By Michelle Diament — Starting this month, individuals with disabilities can accrue more money than ever before in a special ABLE accounts that allows people to save without jeopardizing access to Medicaid and other government benefits....

Jan 9, 2025 | News to Note

From USA Today — By Daniel de Visé and Elisabeth Buchwald — Tax Day is approaching, and soon it will be time to begin assembling forms. If you haven’t looked at them yet, all those numbers and letters – W-2, W-9, 1099 – can easily overwhelm you. Some...